For example, a corporate office might be bought or constructed. Property is purchased for use in a business. Governments use the term capital assets to refer to plant, property and equipment, but again, I will, for the most part, use the term property in this article. I will-at times in this article-refer to plant, property, and equipment as property. In this post, we’ll answer questions such as, “how should we test additions and retirements of property?” and “what should we do in regard to fair value impairments?”Īuditing Plant, Property, and Equipment - An Overview So the dollar amount can be high but the risk low. And the accounting is usually not difficult. After all, it’s difficult to steal land or a building. Plant, property, and equipment is often the largest item on a balance sheet.

If an asset of PPE is sold at the amount higher than its carrying amount or net book value (cost – accumulated depreciation) at the date of the sale, the excess of the proceeds from selling the fixed asset over its net book value is recognized as gain on disposal in the income statement which is income.Today, we talk about auditing plant, property, and equipment (or capital assets if you work with governments). In this case, the company needs to record in the income statement any amount of gain or loss resulting from the disposal of the PPE. This is known as the derecognition of PPE. Disposal of Property, Plant and Equipmentĭisposal of an asset of property, plant and equipment is the process of removing the cost of the asset and its accumulated depreciation from general ledger, by selling or writing off the asset during or at the end of its useful life, so that it is no longer shown on the balance sheet. There are several other depreciation methods that may be used to depreciate the PPE, including declining balance, units of production, and sum of the years’ digits, etc. Note: this is the use of straight-line method to calculate depreciation of the truck. The accounting entry for the depreciation of the truck would be: Account Debit Credit Depreciation expense – truck 8,000 Accumulated depreciation – truck 8,000 The depreciation amount of the first year and the next four years would be : (45,000-5,000)/5 = 8,000 The accounting entry for the truck would be: Account Debit Credit Truck 45,000 Cash 45,000 In this case, the truck would be recognized as PPE because it will be used for longer than one year. The company plans to use the truck for 5 years and expects to sell the truck for $5,000 after 5 years.

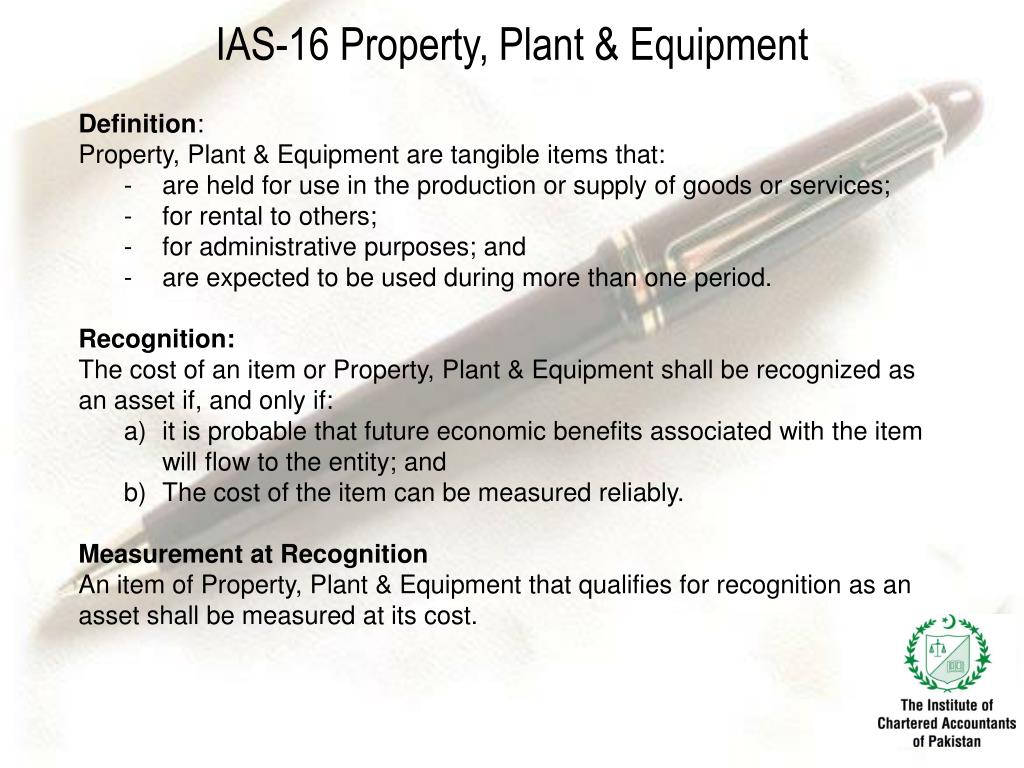

In this case, depreciation of PPE will need to reflect its useful life and the benefits that the company receives from the PPE.ĭepreciation of PPE is recorded in the income statement as depreciation expense, in which it usually reflects the duration that the company uses the PPE and the economic benefits that the company receives from it.Īccounting entry for depreciation of PPE Account Debit Credit Depreciation expense 000 Accumulated depreciation 000 Example of Accounting for PPEįor example, the company ABC bought a delivery truck for $45,000 (using cash) to use in the company. After the company record the item of PPE in the accounting record, it will need to be depreciated as the time passed (e.g. The cost of an item of PPE includes purchased price, import duties, and the costs to get assets to the location and condition ready to use such as transportation and installation cost, etc.Īccounting entry for PPE Account Debit Credit PPE Item 000 Cash/AP 000 Depreciation of Property, Plant and Equipmentĭepreciation is the process of spreading the cost of assets over its useful life. It includes all costs that necessary to bring the asset to the working condition that it can be used as intended. The company records an item of property, plant and equipment initially at its cost in the accounting record. Property, plant and equipment include land, building, machinery, vehicles, office equipment and furniture, etc. The company recognizes an asset as an item of PPE when the asset has a useful life for more than one year and it is used for production or supply of goods or services, for rental to others, or for administrative purposes. Property, plant and equipment (PPE) are the long-term tangible assets that are shown on the balance sheet of the company. Property, Plant and Equipment Introduction

0 kommentar(er)

0 kommentar(er)